The truth is that while some citizens deserve to pay these tax returns, there are also citizens who are eligible for a refund. It all depends on several factors related to us. Income over the past year natural. Some have advanced knowledge when preparing this declaration for submission to the Treasury, while others have very limited knowledge.

For everything, there are several tools that we find on the internet to save and create e.g. give me some more money back, or pay less for that declaration. Of course, you can also seek help from a professional, such as a financial manager. If you have decided to prepare your 2023 income yourself, perhaps this help from us will be very useful to you.

The reason I tell you all this is that when the filing period opens, the IRS itself presents us with its 2023 Utility Income Manual. When designing your return you can see all the deductions we offer, among many other help and advice you’ll find here. It can include both grassroots and community levels.

Pay less tax deductions in 2023

To see all the benefits available to you when planning your 2023 income, see the so-called Real Income Manual 2023 Affiliated with the National Tax Service. You can access it directly from your browser via: this link.

At this point, it’s worth mentioning that the left panel has a series of chapters that will help you tremendously when it comes to optimization. 2023 income tax return. If you are preparing on your own, we recommend that you review all of the sections presented here.

Perhaps the most repetitive and most useful to you are the two chapters that focus specifically on the deductions we can benefit from. For this we will have to focus on chapters 16 and 17 of the manual we have mentioned. The first of these refers to all the usual deductions that we can access and that will benefit us in some way. All we have to do is click on the link.

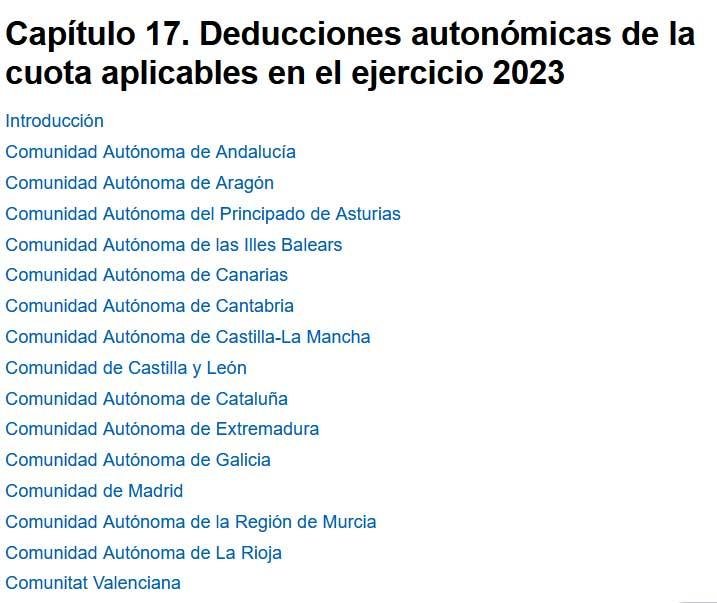

Meanwhile, it’s also a good idea to look at the deductions available depending on the different autonomous communities.

You can learn more about all of this in Chapter 17, which details these deductions depending on where we are registered. Depending on the circumstances of each citizen, we may be eligible for some deductions, but the important thing here is to know all those deductions and also to know the deductions we are eligible for for the area in which we live.